north carolina estate tax return

The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same. Youll need to file a final income tax return for the decedent.

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Purpose For Taxes Who Files And How To File

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return.

. Preparation of a state tax return for North Carolina is available for 2995. Skip to primary navigation. Estatethe estate tax return or the fiduciary tax return and20 pages LAWYERS MUTUAL LIABILITY INSURANCE COMPANY OF NORTH CAROLINAas executor or trustee.

In North Carolina include a complete copy of Federal Form 706. In fact the IRS does not have an inheritance tax while some states do have one. E-File is available for North Carolina.

North Carolina Department of Revenue. Beneficiarys Share of North Carolina Income Adjustments and Credits. PO Box 25000 Raleigh NC 27640-0640.

Carolina but inherit assets. 2021 D-407 Web-Fill Versionpdf. When an estate is subject to the death tax an estate tax return must be filed with the Internal Revenue Service.

Tax Bulletins Directives Important Notices. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to. Complete this version using your computer to enter the required.

So if you live in N. File income tax returns. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

Allocation of Income Attributable to Nonresidents. Up to 25 cash back Update. North Carolina Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms provides access to the largest catalogue of fillable forms in Word and PDF format.

Individual income tax refund inquiries. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the. You may also need to file an income tax return for the estate.

Previous to 2013 if a North Carolina resident died. 2021 D-407 Estates and Trusts Income Tax Return. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706.

The information included on this website is to be used only as a guide in the preparation of a North Carolina individual income tax return. The estate will need its own tax. The Potter Law Firm.

The federal gift tax has an annual exemption of. What Is North Carolina Estate Tax. It is not intended to.

North Carolina has no inheritance tax or gift tax. Owner or Beneficiarys Share of NC. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

NC K-1 Supplemental Schedule.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

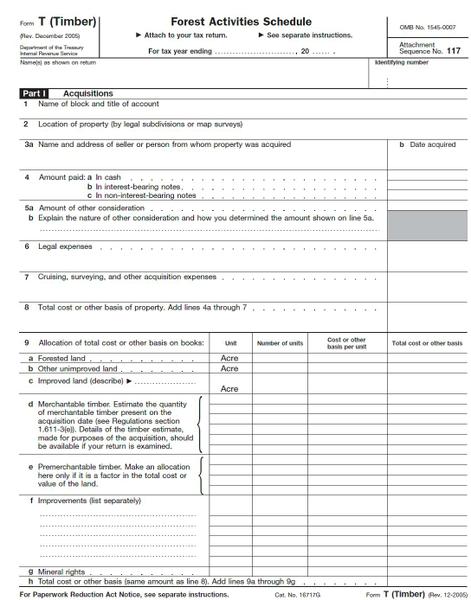

Understanding Your Timber Basis Nc State Extension Publications

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

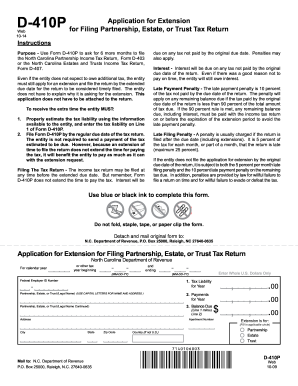

North Carolina D 410p Fill Out And Sign Printable Pdf Template Signnow

Free North Carolina Last Will And Testament Template Pdf Word Eforms

Form A 101 Estate Tax Return Web Fill In

State Death Tax Hikes Loom Where Not To Die In 2021

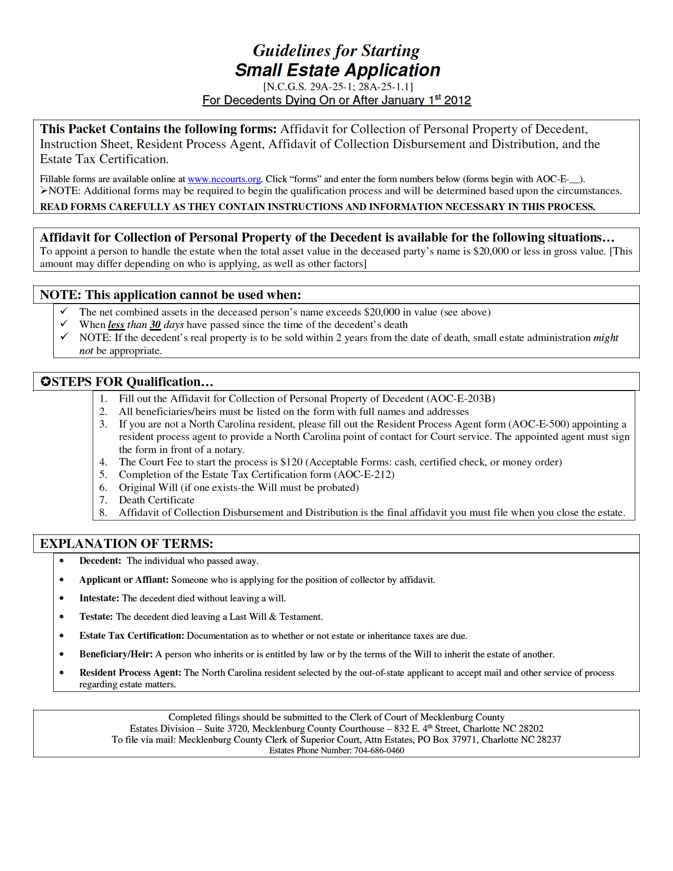

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf

2013 Personal Property Listing Form Stanly County North Carolina

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

A Guide To North Carolina Inheritance Laws

North Carolina Estate Tax Everything You Need To Know Smartasset

Understanding The Estate Tax Return Marotta On Money

Aoc E 212 Fill Out Sign Online Dochub

Tax Comparison North Carolina Verses South Carolina

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate And Inheritance Taxes By State In 2021 The Motley Fool